For anything complex or unusual like distributing a lot of money or cutting. Ad 1 Answer Simple Questions 2 Print Sign Last Will Testament - Free By 415.

Cpa Marketing Make 5 000 Monthly With Cpa Marketing

To draw up the will you could only need one appointment to get all the information and details of the beneficiaries.

. Of course you cant expect the predictions of a CPA to be 100 percent accurate. Occasionally accountants or CPAs try to serve their clients and help them by. Some states also require that the testator have an understanding of the disposition of the assets in the document.

Lenders can only make two unsuccessful attempts at using a CPA to reclaim a repayment then they will be expected to engage with the borrower to find out what is going wrong. Trusted by Millions of People Like You. The procedure for drawing up a will is simple.

While you can download a few forms off the Internet fill them out and have them notarized you might consider having a lawyer draw up your power of attorney papers because a power of attorney for a CPA should contain clauses limiting the powers to certain transactions. The Drawing Account. Can you draft your will yourself or do you need an expert.

A CPA is a Certified Public Accountant who has met all the requirements for licensure. But equally so you should not have your business lawyer prepare your taxes unless that person is also an accountant or CPA. Do you own a condo in Florida.

A second will if you have assets in the United States. Easiest way to create manage your Estate Plan. Should you ask your accountant or CPA to draft my legal business documents.

CPA exam requirements are set by individual state boards and thus vary by state jurisdiction. Lets take a look at what qualifications you need in order to. If any complications or problems arise the attorney might bill you for more time at his hourly rate.

Built by attorneys customized by you. All you have to maintain is clarity as ambiguity can defeat the whole purpose of drawing up a will. Youll need a second will.

As a practical matter yes. This is because a CPA has met minimum education requirements passed a rigorous four-part exam and agreed to abide by a code of ethics. Look for how-to guides in libraries bookstores and online.

A wrongly worded will is as good as not having written a will says. A lawyer can advise you how best to protect your interests. You do not have to use legal language or technical words.

You will need an executor to handle the estate. Now in its fourth edition from Aspen Publishers it covers many types of engagementsfrom audits tax preparation and payroll processing to business valuations and assurance services. Things to consider when you draw up your will so no detail is left out.

What to include in your will. If youre requesting only a will the minimum cost can run from 150 to 600 for an average cost of about 375. Craig W Smalley EA CEP.

It is best to sign two copies. If for example an owner takes 200 cash from the business for their own use then the drawings accounting would be as follows. Drawings accounting is used when an owner of a business wants to withdraw cash for private use.

The attorney then draws up your will according to your specifications. The bookkeeping entries are recorded on the drawings account. Who can legally draw up a will.

But you may not get the best results from either effort. Then a second appointment will be necessary once the will is completed and ready to be signed. The trustees role and steps to.

If you need estate planning advice the answer is a definite Yes. The meaning of English sentences can be changed completely by altering the word order. Ad Create Your Last Will and Testament Online Step by Step in 5-10 Minutes.

Ad Angela Dussault CPA is dedicated to building meaningful client relationships. Although every state board of accountancy has slightly different requirements to sit for the CPA examination most states have the same core set of qualifications that candidates must meet in order to be eligible. Ad 49 star reviews.

It is possible to draw up a will yourself without expert help but it is only advisable if your financial affairs are straightforward and you dont have children you care for under the. Take Control of Your Legal Actions. Its much better to draw up a revocable living trust with the poor over will that it is to have a well.

However you should have the working knowledge of the probate laws in your state. A CPA can use their knowledge of market trends and finances to predict whether the value of your estate will increase decrease or stay the same a few decades down the line. Attorney support in select states.

Modified November 5 2021. Trusts dont go through the probate process. Can my accountant or CPA draft my legal documents.

This includes passing the Uniform CPA Examination which is a rigorous assessment of the accounting knowledge and skills that are directly connected to the work of a newly licensed CPA. For a will to be valid the testator must be of sound mind. And I can prepare your financial statements.

However in many cases these predictions will be very close. Trusted by over 200k members. They will not be.

What the trained professional does is ensure that all the pennies add up. It must meet your states legal requirements and should be notarized. You dont have to have a lawyer to create a basic will you can prepare one yourself.

2001 CPAs Guide to Effective Engagement Letters is a Camico-produced book by Ron Klein JD Ric Rosario CPA and Suzanne Holl CPA. Generally this means that the testator must be an adult 18 or older and be conscious and aware of what they are doing. Simply put an accountant adds value to the client meaning you by taking charge of the situation.

Its not absolutely necessary to use a lawyer to draw up a will. Can a Certified Public Accountant draft bylaws for a start-up nonprofit. Can CPA draft bylaws.

Becoming a Certified Public Accountant CPA gives an accountant higher standing in the eyes of business contacts professional peers regulators and clients alike. You need a financial advisor on your team so its recommended to hire a certified public accountant.

Sample Script Accounting Careers Presentation College Level

Why You Should Ask An Accountant To Write Your Will

How To Make Money The Cpa Way By Flowerysummary794 Issuu

Cpa Marketing Make 5 000 Monthly With Cpa Marketing

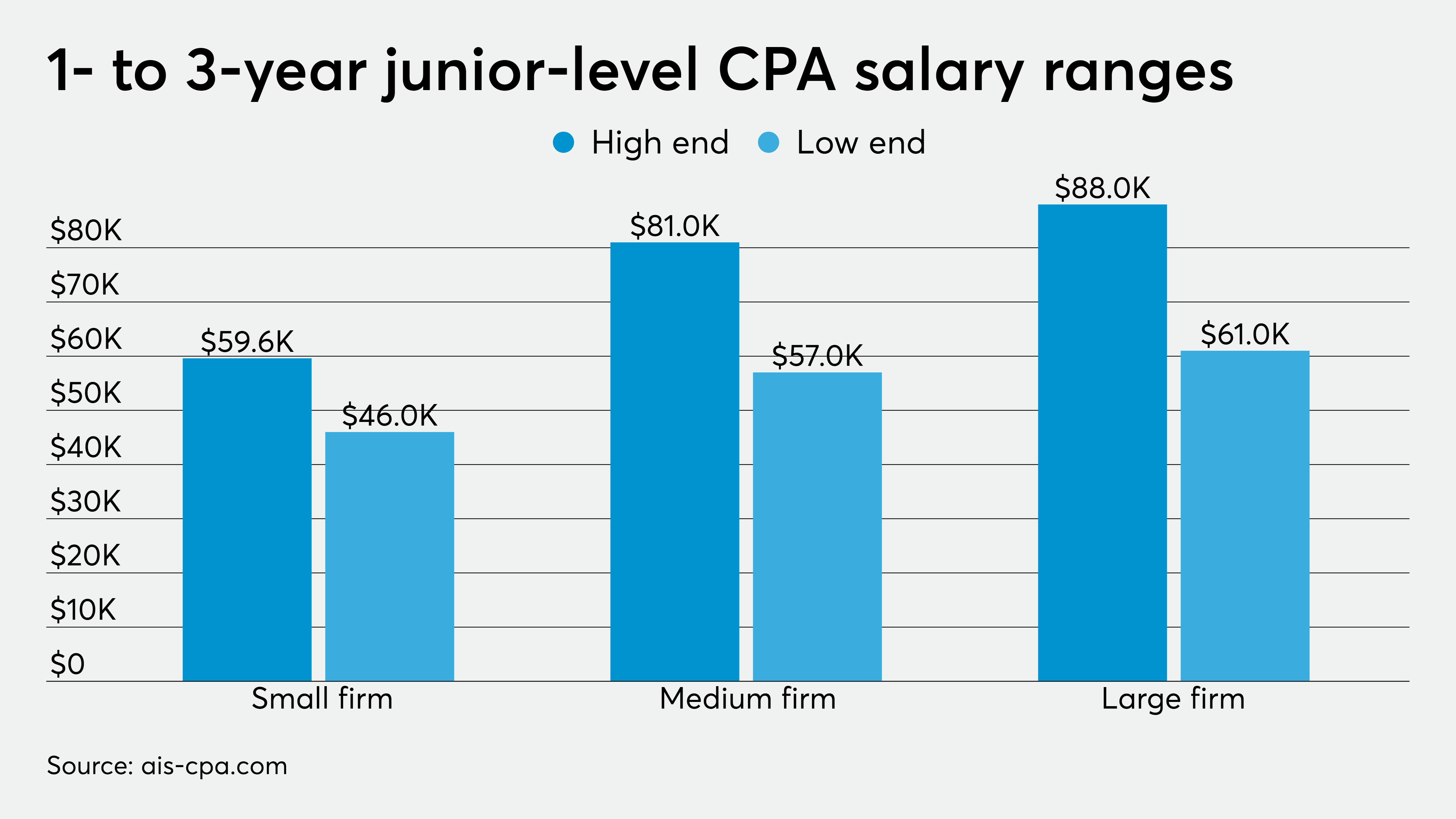

How Much Do Accountants And Cpas Really Earn Accounting Today

0 comments

Post a Comment